Funding the UTP

Unified Transportation Program (UTP)

TxDOT budget overview

The TxDOT biennial budget dedicates funds for the development, delivery and maintenance of new and ongoing state highway projects.

TxDOT’s capital budget reflects the inflationary increases needed to maintain and replace these assets. It also includes important initiatives related to facilities and technology that will continue to maximize the investments previously authorized by the legislature.

Please see the Transportation Funding in Texas funding brochure for more detailed budget-related information.

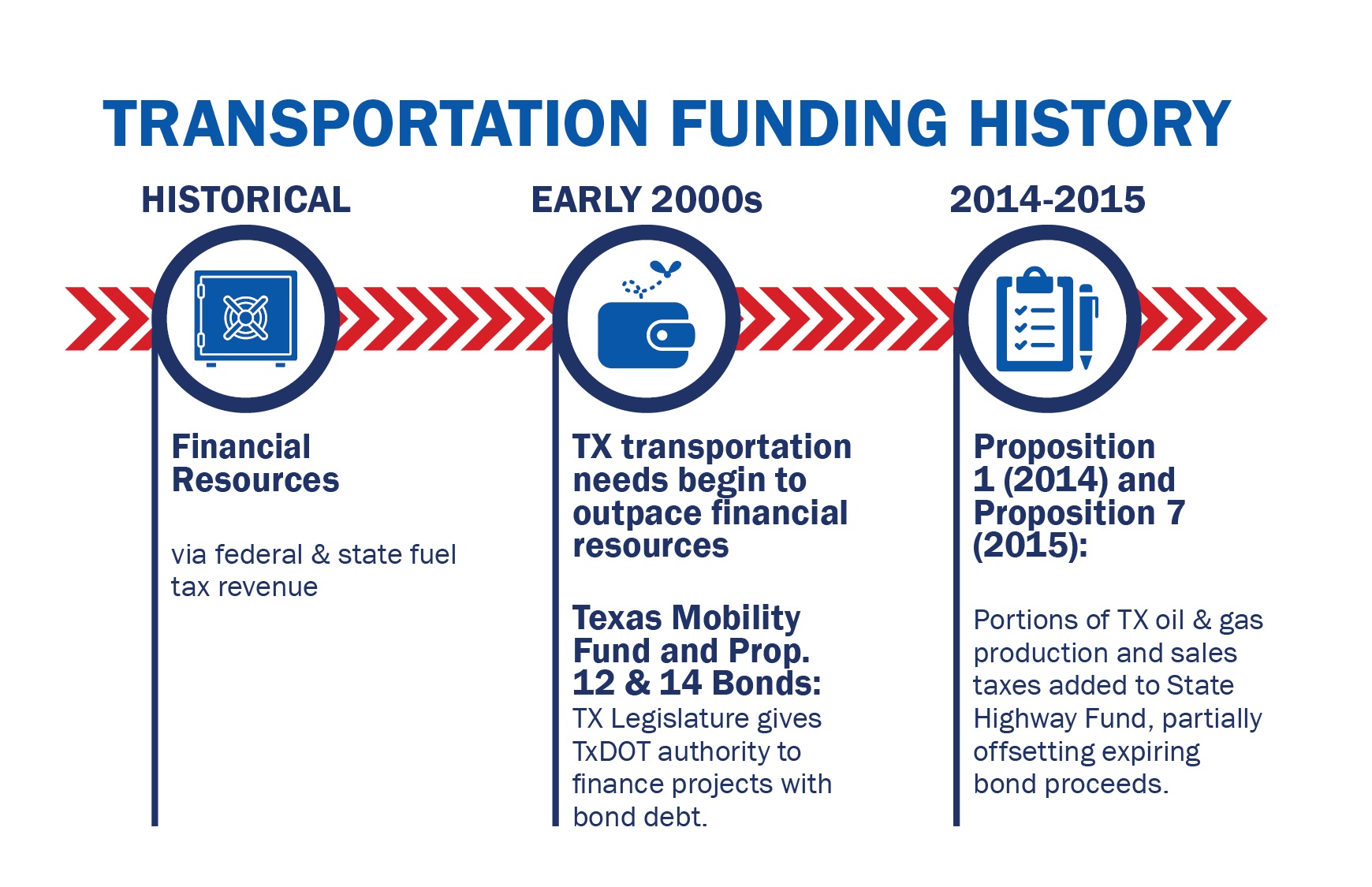

Transportation funding history

Funding transportation projects in Texas has become more complex over the years as new funding sources have been introduced to supplement traditional (gasoline and diesel taxes) ones. Consequently, TxDOT’s cash forecasting and project planning has evolved to adjust to and account for these changes.

- Historical: Financial resources via federal and state fuel tax revenue.

- Early 2000s: State transportation needs begin to outpace financial resources.

- Texas Mobility Fund and Prop. 12 & 14 Bonds - Texas Legislature gives TxDOT authority to finance projects with bond debt.

- 2014-2015: Proposition 1 (2014) and Proposition 7 (2015) - Portions of state oil and gas production and sales taxes added to State Highway Fund, partially offsetting expiring bond proceeds.

Cash forecast

Forecast foundations

TxDOT’s Financial Management Division (FIN) produces a series of short and long-term cash forecasts, which provide an analysis of how much money TxDOT has expended and may potentially be available in the future.

UTP planning cash forecast

At the beginning of each fiscal year, FIN produces the Planning Cash Forecast that estimates cash flow over a continuous 10-year period, thus forming the foundation of the UTP by setting the funding limits for the program. Given that many factors could change over the course of a decade, TxDOT must make assumptions about the future performance of its funding sources when generating this forecast.

Since some transportation revenue streams are more predictable than others, the Planning Cash Forecast process balances the risk of unpredictable cash flow with the need to prepare for potential future funding. Specifically, the Planning Cash Forecast incorporates additional assumptions that allow TxDOT to plan for less predictable funding sources. However, the forecast, like the UTP, does not guarantee funding will ultimately be available for any specific project.

Forecast assumptions (by funding source)

The following content describes Planning Cash Forecast assumptions and considerations in detail and is specified by funding source.

- Incorporates recent historical trends and anticipated future growth rates to project revenues from traditional State Highway Fund sources.

- Directs a portion of the state’s oil and gas production tax revenue to the State Highway Fund for non-tolled highway construction, maintenance, traffic congestion mitigation and rehabilitation projects.

- Visit the Proposition 1 Funding page for more information.

- Dedicates a portion of the state’s general sales tax and motor vehicle sales tax revenues to the State Highway Fund for non-tolled highway construction, maintenance, traffic congestion mitigation and rehabilitation projects.

- Visit the Proposition 7 Funding page for more information.

- The current Planning Cash Forecast includes federal reimbursement estimates that were based on the Infrastructure Investment and Jobs Act (IIJA), as well as updated projections for federal motor fuels tax collections.

- Because many highway construction projects require incremental reimbursements to contractors over multiple years, the payout schedules of individual projects directly affect the forecast’s estimate of future expenditures.

From forecast to UTP

The UTP is constrained fiscally by the Planning Cash Forecast, which means TxDOT can only develop projects that it can afford to execute within anticipated funding limits. For TxDOT to have the right volume of projects ready for construction in the years ahead, the UTP must be based on a reasonable estimate of future cash flow.

In the Planning Cash Forecast, TxDOT estimates available funding for construction projects over the next 10 years. These funds are distributed among the 12 UTP funding categories, excluding Category 3, Non-Traditionally Funded Transportation Projects. These non-traditional funds are not part of the funding forecast, as they come from sources and in frequencies (like single-instance local government contributions) outside the scope of traditional funding sources.

See the UTP Funding Categories Descriptions document for more information regarding UTP funding categories.

Note: The amount of funding in Category 3 Non-Traditionally Funded Transportation Projects is subject to change. The UTP document reflects the anticipated Category 3 amount at the time of the annual UTP adoption.

TxDOT funding sources

State funds

The State Highway Fund (Fund 6) is TxDOT’s primary dedicated state funding source used to support state highways. The primary sources of State Highway Fund revenues come from the state motor fuels tax, vehicle registration fees, sales taxes (Proposition 7) and the oil and gas production tax (Proposition 1).

Federal funds

Revenues collected from federal motor fuels taxes are deposited in the federal Highway Trust Fund. These funds are appropriated by Congress through the Federal-Aid Highway Program and distributed to each state. Most TxDOT projects are funded with both federal and state funds, with the most common share being 80% federal, 20% state. The Federal Highway Administration reimburses TxDOT for qualified project expenditures as they are paid out.

Other funds

Other types of (less common) state funds are also held in State Highway Fund subaccounts. Other state fund types include State Infrastructure Bank loan repayments and project-specific surplus toll and comprehensive development agreement revenues. Local participation may come from cities or counties in the form of funding agreements with TxDOT to expedite certain projects. All Texas Mobility Fund taxes and fees are held in a fund separate from the State Highway Fund.

Transportation development credits, or toll credits, are a means by which states can maximize the use of federal transportation funds in place of traditionally required state or local matching dollars.

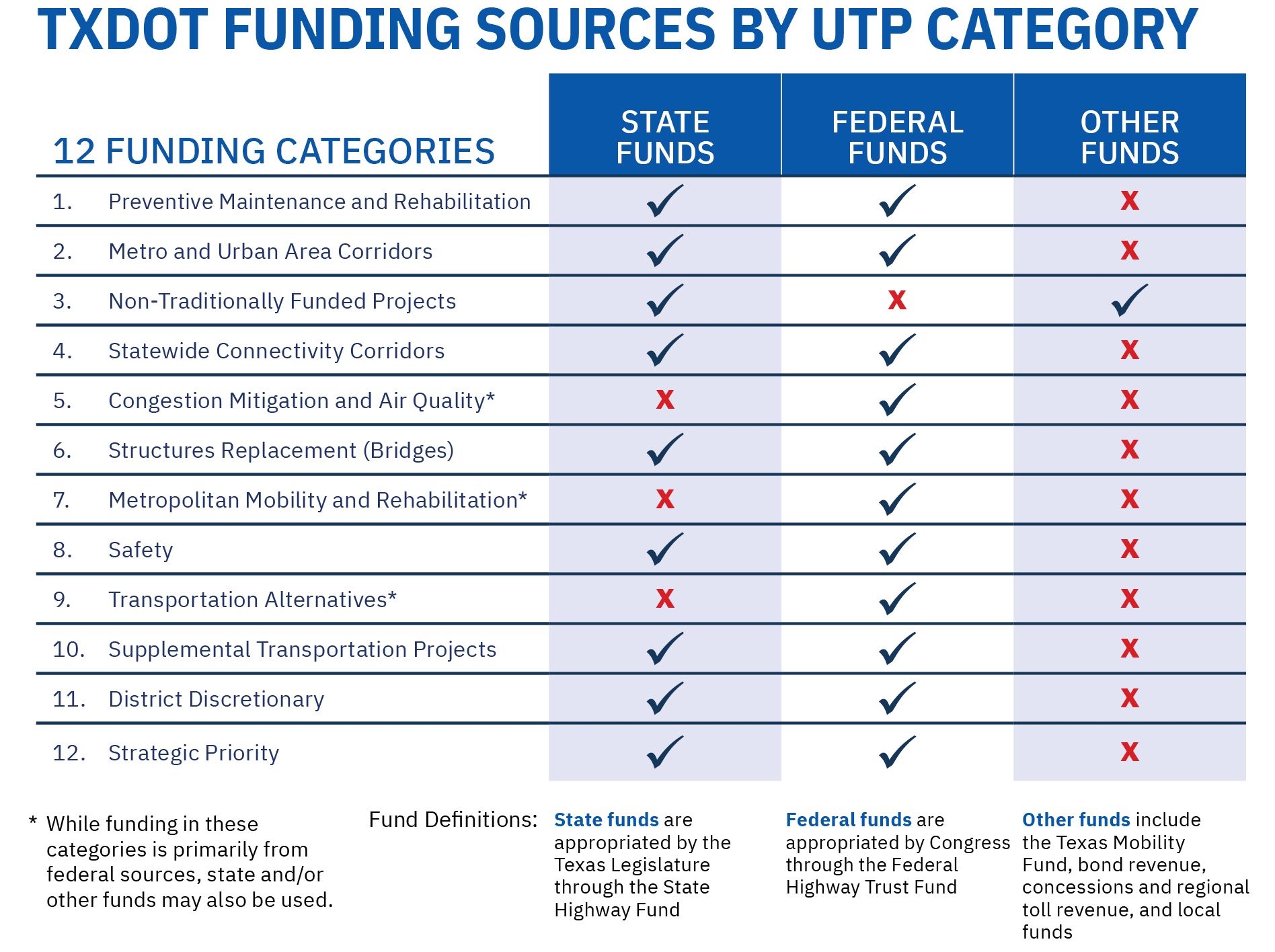

Funding sources by UTP category

The funding within most categories comes from a mixture of state and federal sources. The UTP does not separate state funding sources into distinct categories. Rather, traditional State Highway Fund revenues and Proposition 1 and 7 funds are spread across all state-funded categories. See the UTP Funding Categories Descriptions document for more detailed information.

- State funds are primarily allocated towards all categories except for Categories 5, 7, and 9. While funding for Categories 5, 7, and 9 primarily comes from federal sources, state and/or other funds may also be used.

- Federal funds are directed towards projects in all funding categories except for Category 3, Non-Traditionally Funded Projects.

- Other funds, such as the Texas Mobility Fund, bond revenue, concessions and regional toll revenue, and local funds, are allocated to Category 3, Non-Traditionally Funded Projects.