Proposition 7 funding

Funding needs and potential sources

On Nov. 3, 2015, 83 percent of Texas voters approved the ballot measure known as Proposition 7, which authorized a constitutional amendment for transportation funding. Under the amendment, a portion of sales and use taxes as well as a smaller portion of motor vehicle sales and rental taxes may only be used pursuant to Section 7-c, Article VIII of the Texas Constitution, to:

(1) construct, maintain, or acquire rights of way for public roadways other than toll roads; or (2) repay the principal of and interest on general obligation bonds issued as authorized by Section 49-p, Article III, of this constitution.

This means Proposition 7 funds may also pay the debt service on Proposition 12 bonds, which are guaranteed by state general revenue.

Background

Senate Joint Resolution (SJR) 5 of the 84th Legislature (Regular Session) amended the constitution to include Proposition 7 funding to TxDOT.

Ballot proposition language:

The constitutional amendment dedicating certain sales and use tax revenue and motor vehicle sales, use, and rental tax revenue to the state highway fund to provide funding for nontolled roads, and the reduction of certain transportation-related debt.

The 88th Legislature (Regular Session, 2023) passed Senate Concurrent Resolution 2, which extended both funding components of Proposition 7 – sales and use tax and motor vehicle sales and rental tax revenues – for ten years beyond their original expiration dates. Accordingly, the state’s sales and use tax transfers into the State Highway Fund will be extended through August 31, 2042, while the motor vehicle sales and rental tax portion will be extended through August 31, 2039.

Methodology

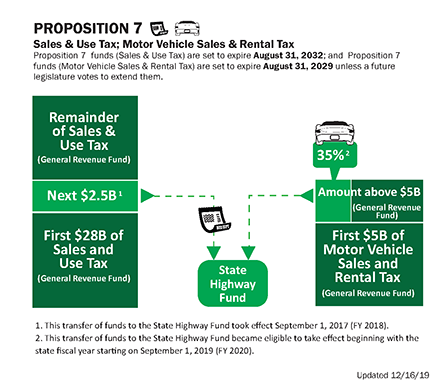

Proposition 7 requires the Texas Comptroller of Public Accounts (comptroller) to deposit in the State Highway Fund (SHF) in each state fiscal year (FY) $2.5 billion of the net revenue from the state sales and use tax that exceeds the first $28 billion of that revenue coming into the state treasury in that fiscal year, beginning in FY 2018. This provision is set to expire Aug. 31, 2042 unless a future legislature votes to extend it.

Additionally, beginning in September 2019 (FY 2020), if state motor vehicle sales and rental tax revenue exceeds $5 billion in a fiscal year, 35 percent of the amount above $5 billion will be directed to the SHF. This provision takes effect on Sept. 1, 2019 (FY 2020) and is set to expire Aug. 31, 2039, unless a future legislature votes to extend it.

| Fiscal Year | Deposits to SHF | Total Deposits to Date |

| 2018 | $939 million | |

| 2019 | $4.061 billion | |

| 2020 | $2.5 billion | |

| 2021 | $2.7 billion | |

| 2022 | $2.99 billion | |

| 2023 | $3.12 billion | |

| 2024 | $3.13 billion | |

| 2025 | $3.21 billion | $22.7 billion |

Factors affecting Proposition 7 deposits to the SHF

Some of the factors affecting Proposition 7 deposits are as follows:

- Proposition 7 funds have two components, each with its own sunset date:

- Funds from state sales and use taxes expire at the end of FY 2042.

- Funds from motor vehicle sales and rental taxes expire at the end of FY 2039.

- The legislature, by a record vote of a majority of the members of each chamber, may extend either of the expiration dates of these two provisions for 10-year increments.

- The legislature, by a record vote of two-thirds of the members of each chamber, may reduce the revenue deposited to the SHF under either provision (with the reduction made in the state fiscal year in which the legislature’s resolution is adopted or in either of the following two state fiscal years) provided the reduction is not more than 50% of the amount that would otherwise be deposited to the SHF in the affected state fiscal year.

More information

For media inquiries, email Media Relations or call 512-463-8700. For inquiries from the public, legislative offices or other government offices, contact State Legislative Affairs.