Financial Management

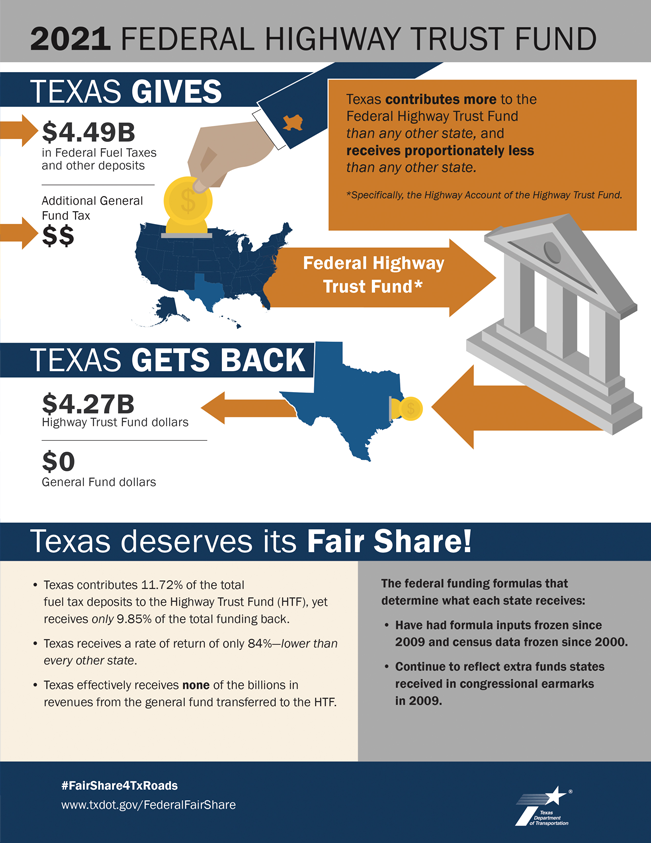

Texas has historically been, and continues to be, the biggest donor to other states when it comes to federal highway funding. The current issue is the result of funding distribution formulas set by Congress with formula inputs that are 10 years or more out of date. This page provides resources for citizens and elected officials to help provide further information on this important issue for Texas.

- Watch: Transportation Funding Press Conference – April 24, 2019

- In the news: Texas Is Once Again the Only Highway “Donor State” As FHWA Distributes $42B in FY19 Funding (Eno Transportation Weekly)