Funding needs and sources

Financial Management

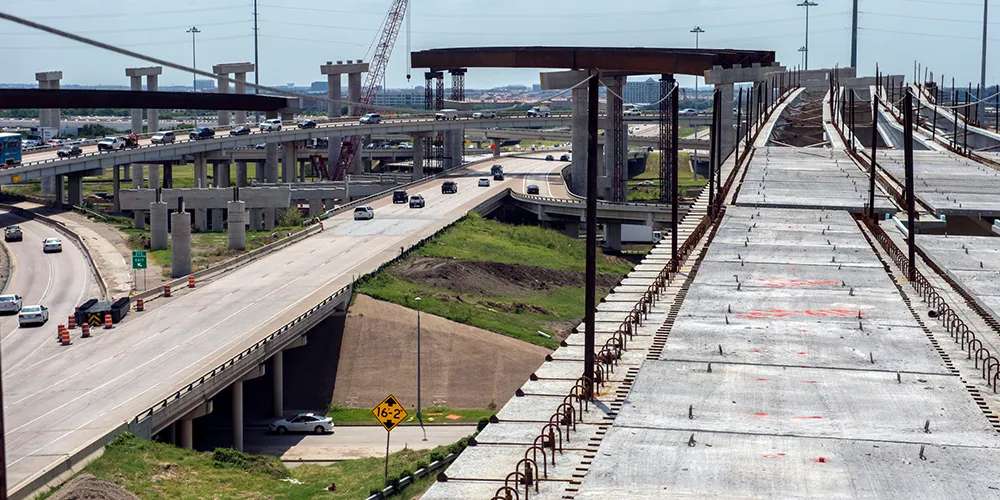

Texas’ transportation system supports millions of drivers, businesses, and communities every day. As the state continues to grow, so does the need to maintain and improve roads and bridges. At the same time, rising construction costs, an aging infrastructure, and increasingly fuel‑efficient vehicles are affecting how far current funding sources can stretch.

Why transportation funding matters

A strong transportation system keeps people and goods moving. It supports safety, economic growth, and quality of life across the state.

What’s driving demand

- Population growth: Texas adds hundreds of thousands of new residents each year, increasing roadway use and long‑term infrastructure needs.

- Congestion: The state’s busiest roadways continue to see more traffic, leading to slower travel times and higher maintenance demands.

- Aging infrastructure: Many roads and bridges built decades ago now need repairs or replacement to remain safe and reliable.

How funding is changing

Every two years, the Texas Comptroller provides a revenue estimate that helps determine how much funding may be available for transportation. Recent updates show both increases and decreases across different funding categories. Some sources, such as Motor Fuel Tax, are growing slowly, while others, such as federal funding, may decline. See below for the recent Certified Revenue Estimate (CRE) released in October of 2025 with details by source:

Total: (-$858M) estimated reductions from CRE for Fiscal Year (FY) 2026-27 and FY 2028 Proposition 1 transfer

- FY26-FY27: (-$481M) CRE reduction from Biennial Revenue Estimate (BRE)

- Increases:

- Motor Fuel Tax: +$11M

- Vehicle Registration Fee: +$232M

- Proposition 7 Motor Vehicle Sales Tax: +$115M

- Reductions:

- Proposition 1 Severance Tax: (-$117M) [FY27 only]

- Federal: (-$723M) [FY27 reverts to prior federal authorization levels that expire in FY26]

- Increases:

- FY28: (-$377M) State Highway Fund Proposition 1 CRE reduction based upon FY27 General Revenue (GR) collections

Current Financial Outlook

- Needs Outpacing Resources: Based on long‑range planning, expected revenues will not fully meet future transportation needs.

- Revenue Uncertainty: Several revenue streams depend on variables like oil prices, federal legislation, and long‑term economic trends.

- Responsible Stewardship: Letting and development targets will adjust based on cash flow models tied to projected revenue and expenses. As a result of latest estimates, targets may be lowered for development and delivery of projects. TxDOT will speed up or delay projects as needed to align with funding and maintain minimal cash balances.

- Ready to Adapt: If forecasts rise or extra resources become available, TxDOT can quickly adjust project development and letting to match increased revenues.

TxDOT resources

- Educational series on funding, 2025-2026

- Texas Transportation Funding Brochure, January 2026 Edition

- Statewide Long-Range Transportation Plan: Connecting Texas 2050

- Proposition 1

- Proposition 7

- SHF financial activity