Section 2: Description and Structure

Description

The Records Retention Schedule is available to employees and contractors on the

, and lists TxDOT records and specifies the minimum period of time official records must be kept before being eligible for destruction. An approved schedule provides the agency with the authority to manage official records and destroy them when their required retention period expires.

Agency Item Number

The Agency Item Number (AIN) is a vital point of reference on the TxDOT Records Retention Schedule. Agency Item Numbers are used for indexing and citation of official records described in the schedule. File Plans are required to associate official records/convenience copies to Agency Item Numbers. Note: OnBase is aligned with Agency Item Numbers to determine retention requirements for official records.

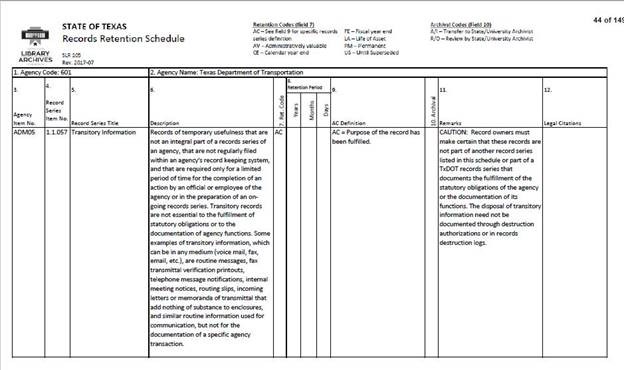

Figure 3-1. Records Retention Schedule

Contents of the Records Retention Schedule:

1 | Agency Code | TxDOT has the Texas State Library and Archive Commission assigned agency code 601 |

2 | Agency Name | Texas Department of Transportation (TxDOT) |

3 | Agency Item Number | A location reference on the TxDOT Records Retention Schedule used for indexing and citation of official records described in the schedule. The Agency Item Number is a unique alpha-numeric code assigned by TxDOT for each record series on the TxDOT Records Retention Schedule. The elements of this number are a three-letter acronym describing the type of record or the responsible office, followed by two digits indicating the sequence of the record series in the schedule. For example, the Agency Item Number ADM04 indicates that the records are in the Administrative record series. |

4 | Record Series Item Number (RSIN) | Records series Item Numbers are assigned by the State and Local Records Management Division of the Texas State Library and Archives Commission. It references specific types of records on the State Records Retention Schedule (

). The first two digits identify groupings of categories of records. For example, 3.1 refers to employee records. If a record series Item Number consisting of five digits appears, the record series is specifically identified in the State Retention Schedule. |

5 | Record Series Title | The most general titles possible have been chosen. Explanations are provided for those titles which are not self-explanatory. Describes the type of record, which may consist of a single specific type of record or file or a group of files that are similar in function and have similar retention requirements. |

6 | Description | A description of identical or related records with the same function and the same retention period that is evaluated as a unit for retention scheduling purposes. This field contains a more detailed explanation for each record series. |

7 | Retention Code | The retention code requires an event to trigger the retention period which is referred to as the retention code to consider before the retention clock can begin. (e.g., AC, FE+3, US+5). AC - After Closed (or terminated, completed, expired, or settled): The record is related to a function or activity with a finite closure date. AV - As long as Administratively Valuable: The immediate purpose for which the record was created has been fulfilled and any subsequent need for the record to conduct the operations of the agency, if any, has been satisfied. CE - Calendar Year End: December 31. FE Fiscal Year End: August 31. FE – Fiscal Year End: August 31. LA - Life of Asset: The record is retained until the deposit of the asset. PM - Permanent: A record that possesses enduring legal, fiscal, or administrative value and must be preserved permanently by the agency. US - Until Superseded: The record is replaced by an updated version. If a record subject to this retention period is discontinued or is no longer required by law, the date of supersession is the date the decision to discontinue the record is made or the law takes effect. If the record relates to an employee, the date of supersession is the date of termination or the last date the record is needed with reference to the employee, as applicable. |

8 | Retention Period | The amount of time a records series must be retained before destruction or archival preservation. The retention period can be broken down into years (Y), months (M) or days (D), or a combination of time periods as required. For example, FE+3 means records must be retained until the end of the fiscal year plus three years, becoming eligible for destruction after September 1 of the third year of its retention. |

9 | AC Definition | AC stands for “After Closed” (or terminated, completed, expired, or settled): The record is related to a function or activity with a finite closure date. AC is used to trigger the retention start date. |

10 | Archival | The Archival Code indicates requirements for records to be sent to archives for long-term preservation or reviewed by the State Archives before destruction. A/I – Transfer to State/University Archivist R/O – Review by State/University Archivist A - The records must be transferred to the Archives and Information Services Division of the Texas State Library and Archives Commission. R - The Archives and Information Services Division must be contacted for an archival review of the records before disposition. Those records determined to be archival must be transferred to the Archives and Information Services Division for long-term preservation. Special Note: Staff of the Archives and Information Services Division conduct archival appraisals on a series-by-series basis. Because of these appraisals, one or more records series of an agency bearing the Archival Code R may be found to lack sufficient archival value to merit transfer to the Archives. |

11 | Remarks | This column contains citations additional information regarding records retention requirements. |

12 | Legal Citations | This column contains citations to applicable federal or state laws or regulations affecting retention. |

Records Retention Schedule Structure

The Records Retention Schedule consists of three parts. The

first part is for common agency-wide records, followed by those

records that are unique to District functions and Divisions. No

single work unit will have all records in the common section. Each District

and Division will have some records on the common section in addition

to the unique records related to their specific operation, such

as routine reports, correspondence, manual development materials

or open records requests, etc.

- The first part lists record series common to all TxDOT District and Divisions and includes types of records related to Accounting; Administrative; Personnel and Safety records. The common record series is inclusive.Common RecordsAccounting, Contracting and FinancialAdministrativeEquipmentHuman ResourcesSafety

- The last two parts of the schedule list unique record series maintained by Districts and Divisions.District RecordsDistrict ConstructionDesign, Engineering and ConstructionDistrict DesignDistrict Bridge OperationsDistrict MaintenanceDistrict Environmental OperationsDistrict LaboratoryDistrict Maintenance OperationsDistrict Marine OperationsDistrict Transportation Planning and DevelopmentDistrict Traffic OperationsAdministration and Division RecordsAdministration and CommissionAlternative Delivery DivisionAviation DivisionBridge DivisionCivil Rights DivisionCommunications DivisionCompliance DivisionConstruction DivisionContract Services DivisionDesign DivisionEnvironmental Affairs DivisionFinance DivisionFleet Operations DivisionGeneral Counsel DivisionGovernment Affairs DivisionInformation Technology DivisionInternal Audit DivisionMaintenance DivisionMaritime DivisionMaterials and Tests DivisionOccupational Safety DivisionProcurement DivisionProject Finance, Debt, and Strategic Contracts DivisionPublic Transportation DivisionRail DivisionResearch and Technology Implementation DivisionRight of Way DivisionSupport Services DivisionToll Operations DivisionTraffic Safety DivisionTransportation Planning and Programming Division