Trucking Firm

There are several ways to count DBE credit for the services of DBE trucking firms. The DBE must have at least one truck and driver of its own, but it can lease the trucks of others, both DBEs and non-DBEs, including owner operators.

The following are ways to count DBE credit for the services of DBE trucking firms:

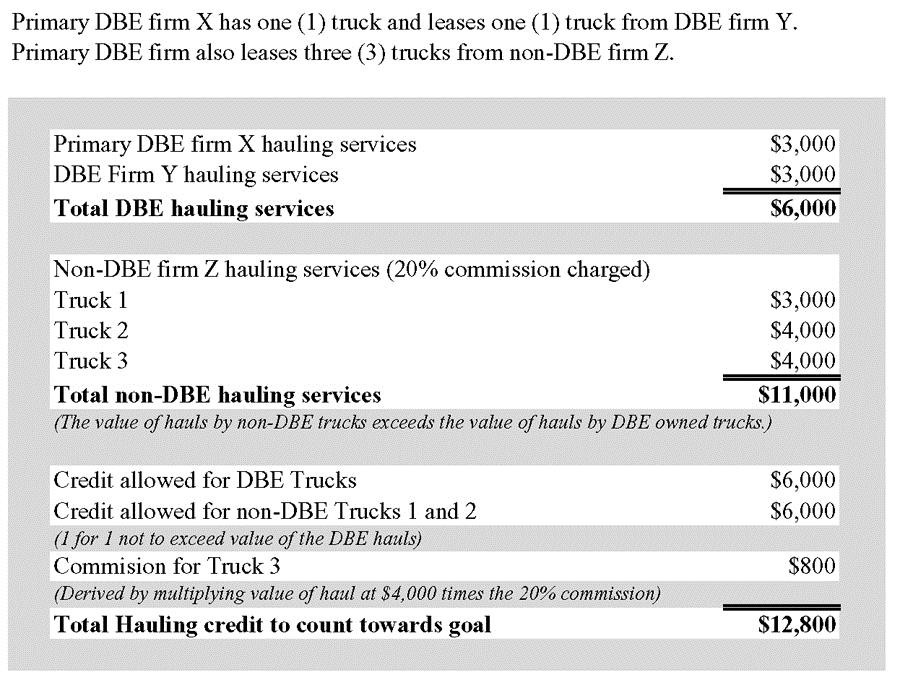

- For work done with its own trucks and drivers, and for work with DBE lessees, the primary DBE trucking firm receives 100% credit for all transportation services provided.

- If a non-DBE trucking firm hires second tier DBE trucking firms and DBE truck owner-operators, then 100% credit will be counted. Credit will not count for the amount of any fees that are deducted from the DBE trucking firm’s payment, such as, fuel costs, other fees, etc.

- If the primary DBE trucking firm leases trucks from non-DBE firms, but uses its own employees as the drivers, then 100% credit will be counted. No credit will be allowed for 1099 employees. The primary DBE trucking firm must own and operate at least one truck used on the project.

- For work done with non-DBE lessees, the primary DBE trucking firm gets credit only for the fees or commissions it receives for arranging the transportation services.

- A primary DBE trucking firm may lease non-DBE trucks on a 1 for 1 basis for credit of the value of transportation services provided. If the hauling services performed by non-DBE trucks exceed the hauling services provided by the primary DBE trucking firm, the credit is limited to the fees and commissions only.

Figure 6-1. Trucking Example