Understanding the Audit Process

After a contract record has been created in DMS and TxDOT begins making payments to the prime contractor, the contract is ready for auditing. Auditing is generated on a monthly basis.

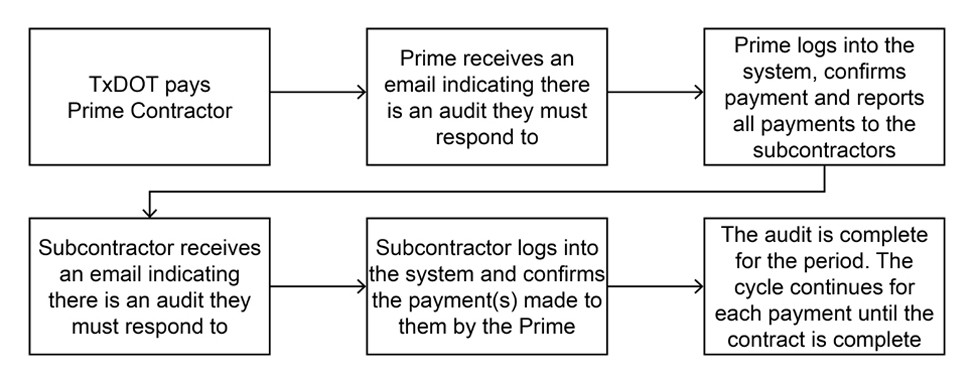

The following image represents the audit process:

Figure 12-1. Audit process for a contract record in DMS.

A prime contractor working on federal-aid projects is responsible for the reporting of all payments to its DBE subcontractors in DMS. DBE subcontractors are responsible for verification and confirmation of payment data received from the prime contractor in DMS. The prime contractor will include payment entries to non-DBE subcontractors whenever there is a DBE associated with a second or multi-tiered subcontract. A DBE prime contractor is responsible for reporting payments to all subcontractors in DMS.

The prime contractor will report payments, after work begins, to meet the DBE goal and for DBE race-neutral participation on projects with and without DBE goals. These reports will be due within fifteen days after the end of a calendar month. These reports will be required until all DBE subcontracting or material supply activity is completed.

See the reporting timeline example below:

Date | Action |

|---|---|

March 10 th | TxDOT pays prime contractor. |

March 20 th | Prime contractor pays DBE subcontractor. |

April 5 th | DMS alters prime contractor to report March subcontractor payments. |

April 15 th | Prime contractor completes entering payments. |

April 22 nd | DBE subcontractor confirms payment received. |

April 23 rd – 30th | District staff completes reporting audit. |